Markets

A New Interest-Rate Era Has Commenced. These Are the Market’s Victors and Losers.

Investors are grappling with a challenging new reality: Interest rates are likely to remain elevated for an extended period.

Stocks

Stocks have experienced a downturn, government-bond yields have surged, and the U.S. dollar has strengthened following signals from Federal Reserve officials two weeks ago suggesting that they might maintain rates at their current levels until 2024.

As we enter the fourth quarter, the S&P 500 has managed to hold onto a 12% gain for the year, but much of the optimism that characterized the first half of the market has dissipated.

“It’s an entirely different mindset,” remarked Sandi Bragar, chief client officer at wealth-management firm Aspiriant. “Investors were aware this was a potential scenario, but they were choosing to overlook it.”

In the upcoming days, investors will closely monitor manufacturing data on Monday and the monthly jobs report on Friday to gauge the strength of the economy and the market’s direction.

Here’s how the new interest-rate environment is compelling money managers to modify their investment strategies.

Bonds had a historically challenging year in 2022. Those who bet on 2023 being better have been proven wrong so far.

Government-Bond Yields

Government-bond yields, which move inversely to bond prices, began climbing again in July as stronger-than-expected data convinced investors that the Fed would need to keep interest rates high to temper the economy. Then, in August, the government announced plans to sell a much larger quantity of Treasurys in the coming months than investors had anticipated, exacerbating summer losses and prompting traders to reevaluate their market outlook.

Anticipations of higher interest rates drive down bond prices because investors fear that future bonds will have larger coupons than current ones. This, in turn, pushes up yields, which represent annualized expected returns, assuming that bonds will be redeemed at their face value upon maturity.

U.S. Treasurys

The bond yields on the 10-year U.S. Treasury note briefly surged above 4.6%, its highest level since 2007, compared to 3.818% at the end of June. The iShares Core U.S. Aggregate Bond ETF, primarily comprising U.S. Treasurys, high-quality corporate bonds, and mortgage-backed securities, is on track for a 3% decline in 2023, marking an unprecedented third consecutive annual decrease.

At the start of the year, big tech stocks were so dominant that they earned the moniker “the Magnificent Seven.” Apple, Microsoft, Alphabet, Amazon.com, Nvidia, Tesla, and Meta Platforms were responsible for nearly all of the stock market’s gains at one point this spring.

However, this trade is now displaying weaknesses as investors scrutinize the lofty valuations of these market leaders with increased skepticism. In September, Nvidia’s shares declined by 12%, Apple dropped 8.9%, and Amazon fell by 7.9%, with only Meta Platforms recording gains.

Interest Rates

When interest rates are low or anticipated to decrease in the near future, traders are willing to pay higher multiples of a company’s short-term earnings to partake in its long-term growth.

The dynamic shifts when investors brace for an era of higher interest rates. They have less motivation to invest in risky assets like tech stocks when they can earn 5% from a money-market fund or high-yield savings account.

Following this year’s rally, some of these stocks appear expensive compared to historical norms. Apple is currently trading at approximately 26 times its expected earnings over the next 12 months, while Microsoft’s multiple stands at around 27, compared to their 10-year averages of approximately 18 and 23, respectively.

Kara Murphy, chief investment officer at Kestra Investment Management, stated, “If you consider the tremendous outperformance of the Big Seven names in the first half of the year, it is statistically highly improbable that we will witness a repeat of that. Even if these names do not decline, we should anticipate a shift in leadership.”

Likewise, dividend-paying stocks are also experiencing downward pressure.

Dividend-yielding stocks are also feeling the strain of current market conditions.

The allure of a stable income from stocks isn’t as strong as it once was.

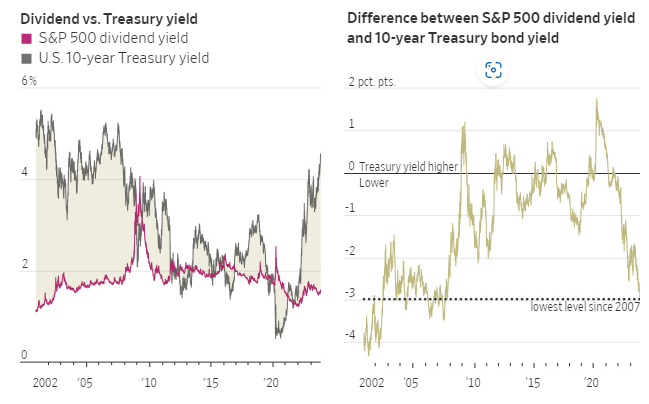

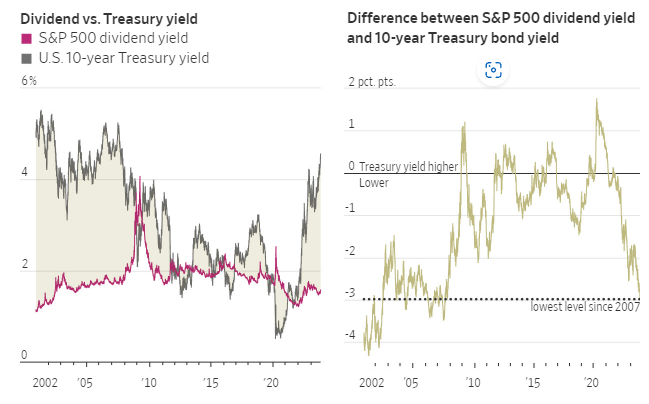

Currently, less than 30 stocks in the S&P 500 boast a dividend yield surpassing that of the six-month Treasury bill, according to FactSet. This marks a significant departure from much of the past decade, when interest rates hovered near zero, and hundreds of stocks in the index provided higher yields. At the close of 2021, before interest rates began to rise, there were 379 index constituents offering more attractive yields than the Treasury bill, as reported by Birinyi Associates.

Investors are finding little motivation to hold onto dividend-paying stocks when yields on risk-free government bond yields are on the rise. Furthermore, these stocks aren’t presenting a sufficient additional yield to offset the risk of a slowdown in business activity.

Some of the dividend-paying stocks that have experienced recent declines include Dollar General and Estée Lauder, both down 37% and 25%, respectively, over the past three months.

Get Three Years of The Wall Street Journal Digital Subscription

Additionally, small-cap stocks are declining at a faster rate than their larger counterparts.

With the onset of a new interest-rate regime, the financial markets are witnessing shifts that favor certain players while challenging others. Here’s a glimpse of who’s benefiting and who’s facing challenges in this changing landscape.

Take 2-years of The Wall Street Journal Print Subscription and Save 77%

Winners:

- Financial Sector: Banks and financial institutions often perform well in a rising interest rate environment. Higher rates can boost their net interest margins, leading to increased profitability.

- Cyclical Stocks: Companies that are closely tied to economic cycles, such as industrials and materials, tend to thrive as economic growth remains robust despite higher rates.

- Commodity Producers: Rising rates can signal inflation concerns, making hard assets like commodities more attractive as hedges against inflation.

- Value Stocks: Value stocks, which typically have lower valuations and are considered more defensive, may gain favor as investors seek refuge from the uncertainties of higher rates.

Losers:

- Growth Stocks: High-growth tech and innovation-focused companies often face headwinds when interest rates rise, as their valuations are based on future cash flows that become less appealing in a higher rate environment.

- Dividend-Paying Stocks: Stocks offering dividends may lose appeal when safer assets like government bonds offer competitive yields without the associated stock market risk.

- Real Estate: Higher borrowing costs can impact the real estate sector, making it less attractive for investors and potentially affecting property values.

- Highly Leveraged Companies: Companies with significant debt burdens may find it more challenging to service their debt as interest rates climb, potentially leading to financial distress.

It’s essential to note that market dynamics can change rapidly, and individual circumstances vary. Investors should adapt their strategies and portfolios accordingly to navigate this evolving interest-rate landscape.